The rise of middle-class luxury brands and media networks.

Everything is a luxury. Everything is a media network. Choose how your brand grows in this economy.

Fast fashion took over consumers a long time ago, nearly killing off some brands that aren’t usually considered fast fashion, even though they are. Their comeback plan includes a dose of nostalgia, escapist lifestyle and luxury aesthetics, and more. From the recent Old Navy x Lindsay Lohan collaboration to H&M hosting Charli XCX events, middle-class brands are using the luxury brand playbook, and luxury brands have also lowered their standards to reach the masses.

All of that and more in this edition of The Social Juice. The Luxury Brands segment was first published in February on Instagram, in collaboration with Sammi Cohen. I’ve updated the content to reflect some recent developments. I hope you enjoy it.

Okay, so you’re not the type to subscribe to paid newsletters. Would a year of non-stop marketing coverage and insights from the best marketers and reports change your mind?

The Identity

America has always been obsessed with identity. One can’t disagree that the 2020s have more in common with the 1960s-70s and the post-World War era.

Just like before, brands are targeting the ambitions of middle-class Americans and giving them a new identity. The consumer culture of the ’50s to ’70s is being reinvented, but why and how? Before, it was about the product; now, it is about everything that surrounds the product.

In the past, having the expensive product and being in certain spaces gave you an identity. Today, having the right product targeting certain beliefs and abandoning certain spaces for your community and self-love is the luxury.

The Whys are many, but the biggest factor influencing the rise of middle-class luxury brands are the wealth divide between Millennials and the constant use of nostalgia and Brand Identities to sell similar products at higher prices. Hmm, Globalisation?

Middle-class luxury brands are private labeling products to target both top 10% and average millennials because they can’t afford being tone-deaf to both groups.

How are brands targeting the middle-class luxury consumers?

Private Labelling

Chaos Packaging

Regressive Nostalgia

Retail experiences

Using micro-trends like quiet luxury/middle class accessible luxury to target certain demographics

Buy now, pay later apps

Creative Directors that bring PR value and cultural credit, not just talent.

Hyper Individualism.

Using entry level products, we have seen a rise in brands using accessories and merchandise to get customers.

Creating Editorial Content for social media.

Brand-on-Brand collaborations.

Social-first companies like Fishwife, Graza, and Away Luggage are at the forefront of this strategy, consistently partnering with other brands in their space to give their customers a sense of community built around the consumption of similar brands.

The list goes on…

Middle-class luxury, as a niche, is very appealing to brands that are typically boring and profit-driven.

Whether it is Family Mart hiring Nigo as a creative director, or supermarkets like Costco leaning into merchandise and in-store brands to give their average consumers a new identity. Target saying "kate spade new york" collab was one of its largest launches.

Or airlines making a comeback by repositioning themselves as the go-to for entertainment and comfort. Delta partnering with YouTube for a free premium experience, and Spirit Airlines selling more legroom as their main brand platform, "More Fly.”

These brands know they have a better chance of winning over middle-class consumers compared to luxury brands, which are currently trying to launch new brand extensions and products for the middle class. If high luxury has consumers aspiring for their products, mid-luxury already has those customers. The primary reason they are doing this is customer retention and loyalty.

In the '60s and '70s, these brands went through a similar transition. People weren’t buying into airlines as much as they do now, and they weren’t really into consistent consumption. For profit, this system had to go, and we all know how the product quality degraded year after year. But the focus was still on the product.

We had infomercials, clever product placements, celebrity endorsements, and copywriting influencing the consumer to spend more. The branding clues were more verbal and about the product, not the brand.

As we know, the degradation continued, and the internet changed the dynamic of advertising. The product lost its place as the face of a company. Brand identities took its place. For a while, brands used celebrities and influencers to sell the brand identity. What we have seen recently is different: brands partnering with each other to sell a new identity. Ex: GAP x DÔEN.

What’s considered a luxury has also changed: Having a Home, Kids, Community, Taste and Health. Having a normal life is not normal anymore. At least for young adults who are struggling to get their hands on physical property but they can easily finance their personality-driven purchases with BNPL.

Update: Those BNPL payments will soon determine your credit score.

More importantly, people are forced to live lifestyles that sell and earn jobs or cultural credit. The present version of “someone that uses AI will take your job.” is “someone with personal brand or willingness to sell their identity will take your job.”

Something else that plays a role in this rise of middle-class luxury brands is regressive nostalgia* and infantilisation of Millennials and Gen-Z.

The use of nostalgia to target consumers has been going on for decades. The nostalgia we have today is not even real. But it’s a great selling point!

In a 2009 New York Times article, Frank Cooper, Pepsi-Cola’s chief marketing officer for sparkling beverages, stated, “It’s about yearning for the past, a simpler time, even though the ’60s and ’70s were not simple.”

“They just seem simple, looking back,” he added.

Overtime this use of nostalgia to give consumers comfort during hard times has lead to infantilisation of Millennials and Gen-Z. The corporations try to upsell their products through IP collaborations like Barbie, Snoopy, Powerpuff Girls and Walmart x Gilmore Girls, etc.

Streaming is King: Warner sold A Christmas Story to Wayfair and Harry and Sally to Hellmann’s for Super Bowl campaigns. Tubi is turning e.l.f. Beauty, Nerds Candy, and Poppi’s Super Bowl ad campaigns into Tubi movie trailers.

The studios are rebooting every TV show and Luxury brands like Louis Vuitton are recreating their best collaborations: Takashi Murakami x LV.

Luxury brands are also struggling in China, and they are finally stepping down from their pedestal to meet western consumers where they are.

Recently, Louis Vuitton has been on a middle-class luxury brand acquisition spree. To maintain their dominance in the US and EU, they have invested in brands like Birkenstock, Polène, French Bloom, Our Legacy, and others.

L’Oréal has acquired Aesop, Galderma, and Amouage to target the affordable luxury sector.

These brands are doing everything to build new brand extensions and are following the P&G House of Brands strategy. And investing more in China and other locations to rebuild their brand experience. Luxury brands are closing stores but opening flagship locations.

Louis Vuitton's latest Shanghai store is not your average luxury flagship. The 30-meter-high, ship-shaped store, "The Louis", is billed as an experience, and houses an exhibition space and cafe in Shanghai's downtown Nanjing Road shopping strip.

Luxury Companies are also integrating their brands into sectors that are already big in the west, Hospitality and Food collabs, like La Table Alaïa and Miu Miu Summer Reads.

The mergers and acquisitions, hidden investments in other brands and external differentiations are being made by corporations to make sure the cultural divide doesn’t impact their overall business.

The rise of middle-class luxury brands isn’t surprising at all.

First, who even is middle-class changes every day, and most people don’t agree on a single definition.

Second, The perceived value of a brand is no longer tied to price or quality. Social Media and Global Supply Chain Shift has completely changed what makes a product worth the money.

Third, The overuse of nostalgia and pre-built context about products and brands in marketing has overhauled what people think about companies. If people can’t even differentiate between real or fake nostalgia. They hardly know what a historic brand stands for.

Fourth, Fashion & Entertainment Brands that are bound to shareholder culture use creatives with big fame to repurpose what already works because the fans of XY person will always interpret same product differently because of messenger effect.

Fifth, the Chinese luxury market was very healthy for brands. The demand for top-selling products allowed fashion houses and other brands to experiment and build new collections around their key principles. Meanwhile, the culture in the West presents a challenge for luxury brands, as the values and expectations of Western audiences differ from those of Eastern consumers.

Through mass marketing and brand extensions, the brands are now trying to target those middle-class buyers and change their cultural POV about luxury.

Sixth, everything is an aesthetic. Everything from fast fashion brands copying runway pieces to news publishers pushing articles about every other trend. A ton of people aren’t sitting long enough with products and stories to value their purchases.

According to Sprout Social, 81% say social drives them to make impulse purchases, and 73% say they’ll buy from a competitor if a brand doesn’t respond on social.

Last, the identity crisis that never ends.

My Recommendations for you…

Bliss Foster’s recent video “The imminent death of luxury” goes quiet deep into how fashion brands are suffering. He debunks a lot of trends that some marketers on TikTok think are actually reviving the luxury wave.

- ’s report “The Blurred Lines between mass and Luxury” is a much more organised and in-depth version of my write-up. Her reporting influences one part of my thinking when it comes to anything related to fashion.

White Paper: Luxury Redefined.

Who’s trying to sell attention to each other?

A Timeline of media network launches from Retailers and other form of businesses to sell your data & attention to advertisers.

Brands are now selling your/their attention and data to each other through media networks and platforms designed to simplify everything related to media buying and selling.

Pioneers of retail media networks, like Amazon and Walmart, are going even further, acquiring other digital platforms and companies like Vizio to expand their advertising reach.

Walmart began allowing advertisers to bid on other brands’ search terms this year, one Walmart Connect advertiser told Adexchanger at the IAB conference.

The attention-selling business is proving to be more profitable than the actual core business of these companies. While Target is suffering from boycotts and economic pressure, its ad business is doing relatively well.

Meanwhile, Amazon continues to chip away at Google’s and Meta’s ad businesses.

The success of retailers has inspired finance companies like JPMorgan and PayPal to use customer data and their own media ecosystems to capture additional revenue.

While the number of media networks continues to rise, trust in them is wobbling. Recently, DigiDay reported that, “Critics argue that the negotiation process between brands and retail media networks has become less about negotiation and more about quid pro quo–style deals.”

Arktic Fox finds that 54% of marketers have low trust in retail media networks, despite the sector's rapid growth in Australia. The IAB reports that 62% of retail media buyers cite a lack of measurement standards as a top challeng to continued growth.

Amid all this chaos, there are also some good attempts to persuade brands by using attention metrics. Recently, CO-OP partnered with Lumen on a study to highlight the effectiveness of their small store media network.

Attention Economy isn’t only about attention. It’s about how you use attention to benefit your business. And sometimes, that means sharing it with others and threatening the role of some media agencies.

🍊Sponsor Break: Brands built around entertainment grow faster than traditional competitors. 96% of the global Top 30 most entertaining brands saw revenue growth is the past year. Put simply, being entertaining pays.

Find out what brands rank on Tracksuit's global Entertainment Index.

People are talking about your brand. But no one is buying.

In marketing, there are always two different classes. People move between them, but one mostly talks about the brand, the other buys. It’s the OG loop.

Most brands think if you win/buy the first class: Influencers, Distributors, Celebrities, Media, and more, they will create word of mouth for the business, and eventually the second class will just start buying the product.

Well, that almost never happens. Because…

There is a huge difference between corporate-generated WOM and organic WOM. One spreads on its own, the other needs to be in sync with overall marketing efforts. And you’re probably doing it wrong.

The first reason is corporate-generated WOM, like influencer recommendations, seeded marketing campaigns, paid user-generated content, ambassador programs, etc.

All of these brand messaging platforms usually leave no room for independent interpretation by consumers.

Go to your grandma or grandpa. Ask them about a great or cult brand from their adulthood. Write down the answer. Then ask your grandaunt, or someone from their generation, about the same brand. Notice the difference between their explanations and your grandparents'. You will find minimal difference. And that individuality in their responses proves there was room for interpretation, provided by that brand.

Your brand needs to provide that. Let the consumer add their own interpretation to whatever is being promoted. And that’s before purchase.

If your paid WOM isn’t transitioning into organic WOM, it’s just a failed marketing campaign. Even if your brand sees an increase in sales for a while, the objective of the campaign was to create long-term awareness and WOM.

The second reason for failure is too much focus on the product aspect of word-of-mouth marketing. Your brand is looking to get 10–15 words out of a person’s mouth about the brand. If you hyper-focus on that aspect of WOM, you will lose.

You have to remember that, at first, it is just two people talking. The first task of WOM is to get people talking about something, and that something is your category or industry.

And to show up in that conversation, you have to test for prompted and unprompted brand awareness. To make sure your WOM campaign is positioned according to how much people in X or Y industry are aware of your brand.

That’s for big brands. For small brands, just remember that the work begins with making people talk about your category. And then, you try to prompt a conversation about your brand.

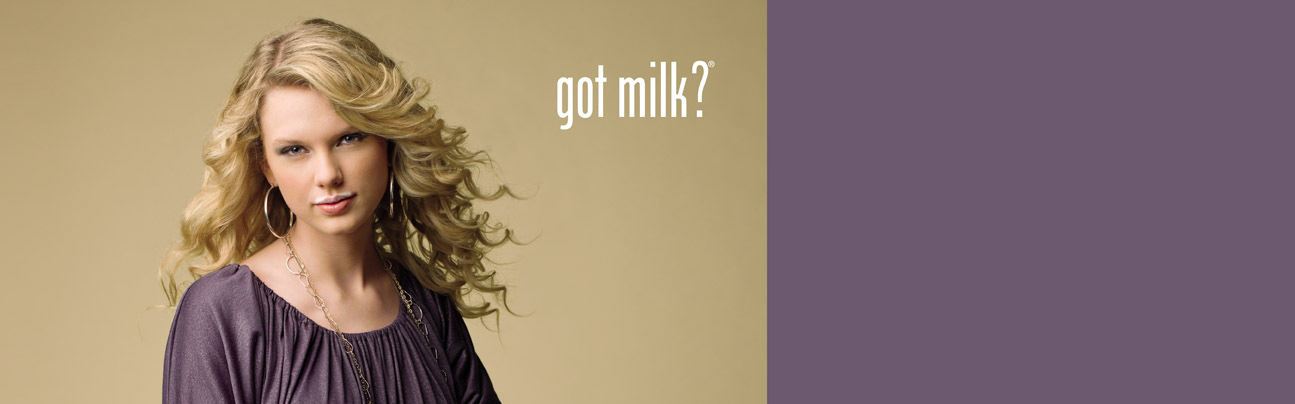

Take “Got Milk?” as an example. Ignore the popular celebrity-driven ad campaigns, that’s advertising. Focus on the slogan and the brand “Got Milk?” It’s rooted in category awareness, which helps all brands win, not just one.

Based on how you spread the word about your brand and how you prompt the conversations, your product will either be sold like an MLM scheme or people will buy it like milk.

“Got Milk?” makes me recall how much WOM is situational. As the industry matures or becomes more traditional, it becomes harder and harder to make WOM happen for your brand.

And you need to factor that market position in to tune your brand message.

Imagine you have nailed all of your corporate-generated WOM efforts. Now what? People will start buying your brand, but the long-term success depends on your next step.

Advertising vs Promotion.

A 2019 study titled “Seeding as Part of the Marketing Mix: Word-of-Mouth Program Interactions for Fast-Moving Consumer Goods” reveals that combining your corporate-generated WOM with sales promotions is more effective in making people buy than combining your WOM with other advertising efforts.

This research focused primarily on offline WOM. There might be a possible difference in how people interact with other forms of advertising after consuming WOM through efforts like influencers, social media and UGC.

From my experience, promotions are the ideal choice, whether online or offline. Trust in influencers and fake UGC is fragile, and everyone can easily recognize it.

As Typeform’s new report shares, “Only 1 in 3 consumers believe influencers use the products they promote, and 56% of influencers admit to promoting products they don't actually like.”

In terms of WOM in B2B, the study reveals, “In a business-to-business marketing environment with more customized and complex product solutions, personal selling—which ought to be information-rich and adaptive, similar to face-to-face WOM—exhibits positive instead of negative synergies with TV advertising (Gatignon and Hanssens 1987; Gopalakrishna and Chatterjee 1992).”

The study offers an important lesson. A balance needs to be kept between corporate-generated WOM and other forms of advertising.

It’s similar to how brand and performance marketing need to be balanced. The inorganic seeds of your message need more room to grow and become organic WOM. Your marketing mix needs to support that growth.

How you frame your promotions and products also matters, especially on your website.

The solution to win the online consumer is to focus on user-based recommendations, not item/product-based recommendations. “Customers who like this also like . . . ” is a user-based condition, and “Similar book to this” is an item-based condition.

Amazon uses user-based conditioning to make billions on their platform. According to a study titled “Making Recommendations More Effective Through Framings: Impacts of User- Versus Item-Based Framings on Recommendation Click-Throughs,” recommendations framed as user-based (vs. item-based) might exert more influence on customers by adding a social component to the recommender system.

When you make it about the buyer, you make it a taste-driven decision, more sociological than economic. On your social and website, making the primary or secondary product purchase a sociological decision, a matter of taste, helps a lot.

To take full advantage of this human behavior, brands usually show you more interactive product images. The model is wearing ten different products. There are AR filters and a hundred other upselling tactics. I mean, look at TikTok Shop and how Amazon added a For You feed to their app.

While social media is becoming more like TV, companies are making their websites a social play. Turning on all of your anxieties. Making the purchase less about actual needs, more about psychological ones.

And that’s the formula. Make people talk about your industry, then your brand. If offline, the social element of life is already there, and a sales promotion is the last push. If online, create a social element on the website. Give them a promotion. Or sell the anxiety.

TL;DR

People are organically talking about your brand, but they aren’t buying. The problem might be your website and in-store experience. The purchase decision is coming across as more economical than sociological or personal. You have a consumer experience problem.

Your brand is paying people to spread word-of-mouth about the product, but they aren’t buying or sharing it further. Your marketing efforts are either out of sync, or the WOM campaign feels too manufactured.

Is this marketing genius or an experimental campaign?

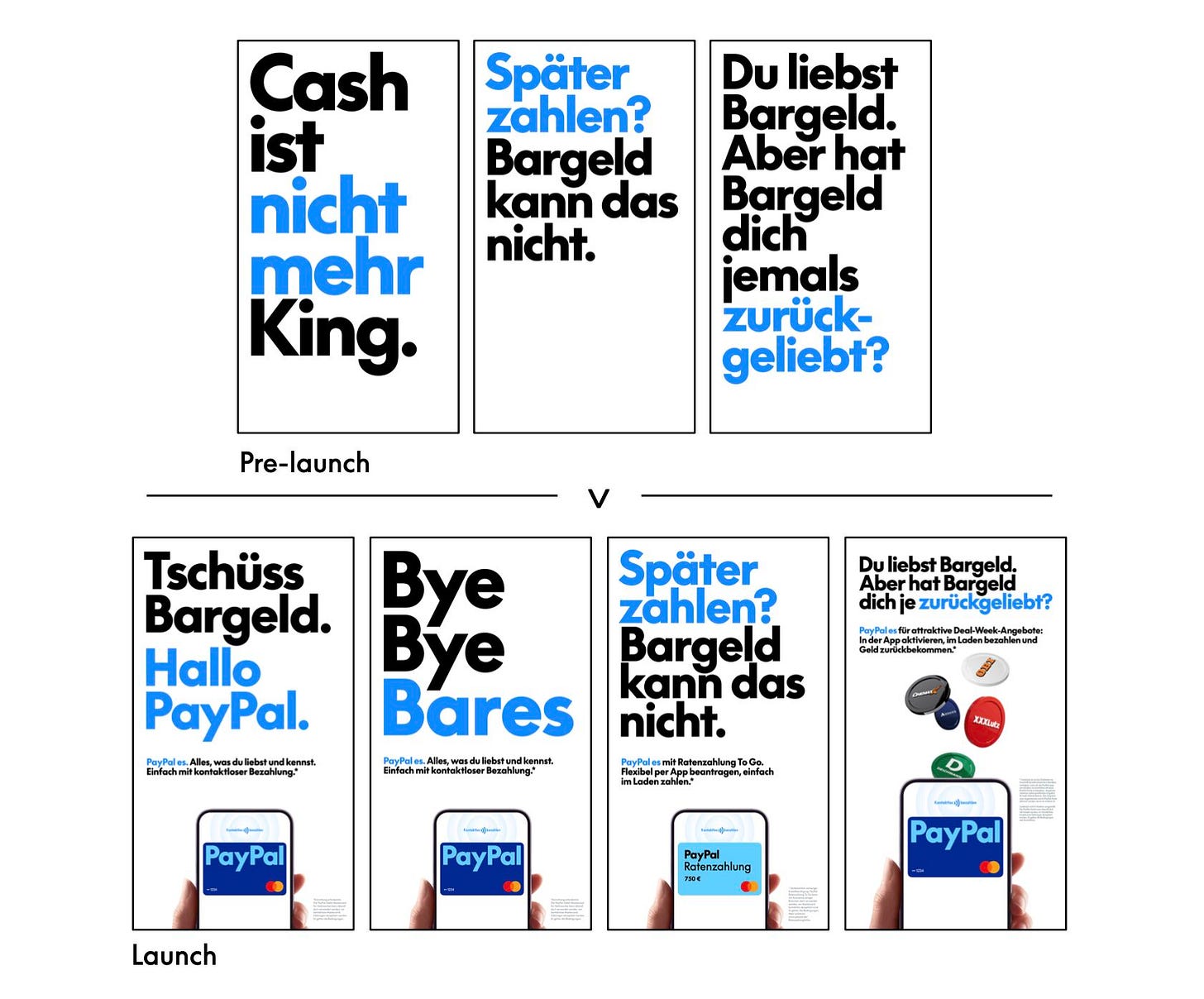

PayPal’s prelaunch campaign in Germany, with no logo and only brand colors, went semi-viral a few weeks ago.

The intent behind the overall brand campaign is simple: PayPal wants to be the new Apple Pay. But since they can’t fight or call out Apple directly, they are fighting cash instead.

In the prelaunch version, they call out the “death of cash,” and the post-launch version highlights PayPal as the new solution. The structure is very simple: highlight the problem and present your brand as the ultimate solution.

They also experimented with media format and distribution. They ran ads with no logos so people would perceive the campaign as an unbranded message, followed by the branded version.

The Reaction:

People in r/Berlin and other subreddits were confused.

On Twitter, people were arguing about cash vs. cashless.

Marketers on LinkedIn were upset with the campaign for not following traditional marketing rules.

I think this campaign works to a certain extent, as it did kick off a discussion about cash vs. cashless, with PayPal at the center of that conversation. But I don’t know if they generated enough positive emotion to make people consider PayPal over Apple Pay.

Some people even thought the ad campaign was for Klarna, as the “später zahlen/pay later” message felt more on-brand for them.

Overall, I think this campaign is still achieving something, and PayPal isn’t particularly known for good advertising. Also, the copywriting in the English ads from last year was worse. We even made a carousel about it.

Smackdown? My opinion doesn’t matter. Apparently, 1 million people enrolled in the PayPal card product before launch day.

Now over to you: do you approve of this campaign or not? Please share!

Back on Sunday…